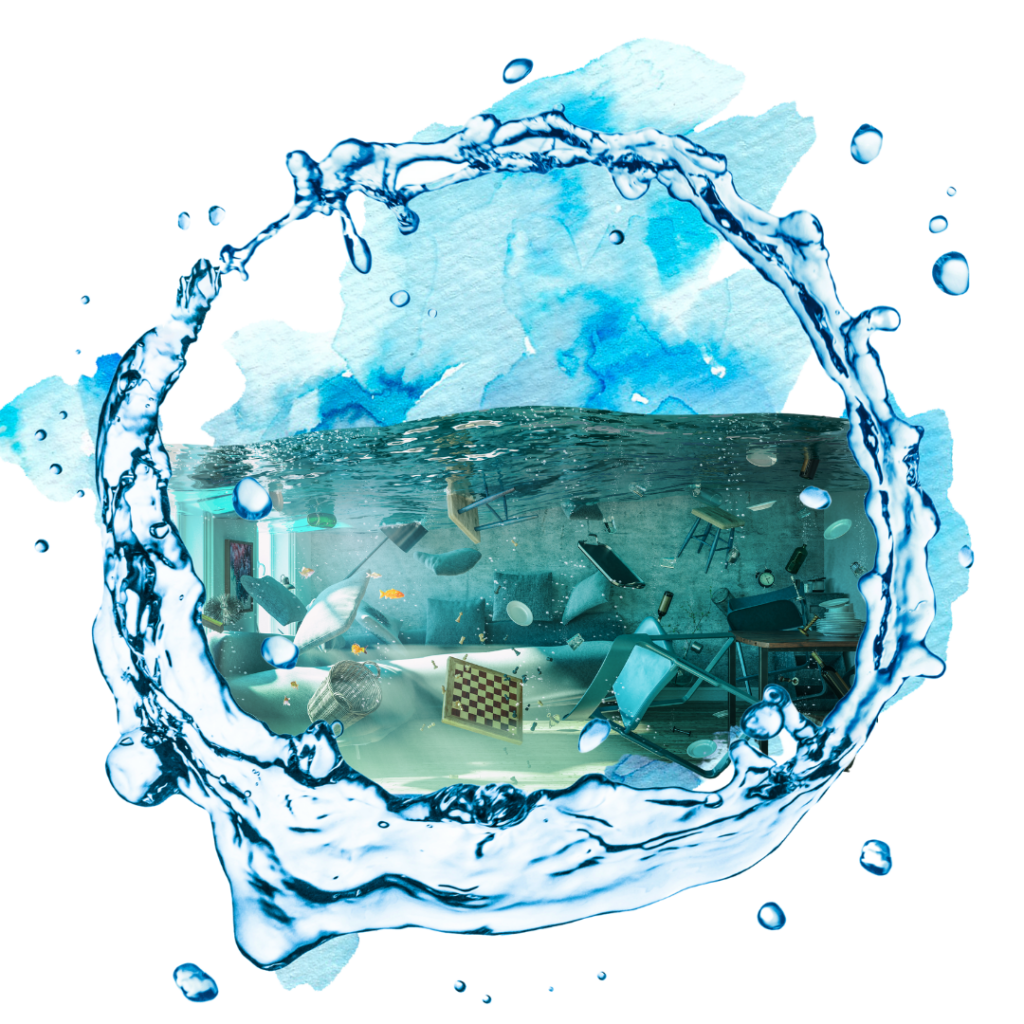

Floods can happen unexpectedly—don’t leave your property unprotected. Our flood insurance plans provide the financial security you need to recover from water damage. Get covered today and stay prepared.

At Ocean Trust, we provide reliable flood insurance solutions designed to safeguard your home and belongings from water damage. Whether it’s from heavy rains, storm surges, or unexpected flooding, our coverage ensures peace of mind and financial security. With our expertise and personalized service, you can trust us to navigate the complexities of flood protection while you focus on what matters most. Choose us for comprehensive coverage, affordable plans, and exceptional customer care.

Protects your property's structure from flood damage.

Safeguards personal belongings inside your home.

Covers damages to the foundation caused by flooding.

Helps cover the cost of flood debris cleanup.

Provides housing assistance during home repairs.

Covers flood-related water damage restoration.

Covers the physical structure of the home, including walls, floors, windows, doors, and the foundation.

Also includes built-in appliances, plumbing, electrical systems, and HVAC systems.

May cover detached structures like garages, but often with lower limits.

Covers personal belongings inside the home, such as furniture, clothing, electronics, and appliances, if they are damaged or destroyed due to flooding.

This coverage typically includes items that are not permanently attached to the structure

Flood insurance typically does not cover:

National Flood Insurance Program (NFIP):

In the U.S., flood insurance is often available through the NFIP, a federal program administered by FEMA, or through private insurers. NFIP policies have set coverage limits (e.g., up to $250,000 for building coverage and up to $100,000 for contents) and specific terms.

Flood insurance is important for homeowners and renters in flood-prone areas, especially as certain regions may face mandatory flood insurance requirements if they are in designated flood zones.

809 N Homestead Blvd, Homestead

+1 866-356-2326

info@oceantrustinsurance.com

Start your journey to peace of mind with a personalized insurance quote. Share your details, and our dedicated team will provide you with a no-obligation, free estimate tailored to your needs. Let us help you protect what matters most.